In this article

Of the many stated priorities from DoD leaders over the past few decades, one in particular has simultaneously increased in both its importance and difficulty to accomplish. The task, explicitly stated in the National Defense Strategy, happens to rest squarely on the shoulders of financial management leaders across the DoD.

“Gain full value from every taxpayer dollar spent on defense, thereby earning the trust of Congress and the American people.” [1]

In this article, we discuss why strategic financial decision-making is such a difficult task to accomplish and what solutions may assist the full spectrum of the workforce, from financial analysts to senior leadership. We discuss positive ways to harness data, outline the purpose of decision science, and explain how you can use data and technology to make effective decisions and maximize resources.

The Abundance of Data

When talking with comptrollers, budget officers, or financial managers, we are reminded of the famous words by poet T.S. Eliot:

"Where is the wisdom we have lost in knowledge?

Where is the knowledge we have lost in information?”[2]

Good data and information are a means to a successful end, but managing data consistently comes up as a major roadblock. It’s not for a lack of information, but instead, the opposite: we have too much of it! The challenges are keeping the data accurate, accessible, and automated.

But sifting through, updating, and organizing data is not for the faint of heart, and managing data is one of the major challenges facing stewards of taxpayer resources. Complex relationships must be understood, field definitions must be clear, and data naming conventions must be consistent. Spreadsheet-based data collection tools and systems, while widely available, are labor-intensive to manually maintain and a breeding ground for data entry errors and configuration issues. In addition, spreadsheet data management processes fall short in quick analyses, with many components and decision factors stored in disparate locations, making data difficult to pull together in a timely manner for leadership.

Many of us have been there, haphazardly working through stress-filled exercises that may lead to undesirable results. Reliance on erroneous data ultimately alters the future course of a program, possibly in the wrong direction.

The Purpose of Data

As we wade through these challenges, in our pursuit of good data we sometimes forget that it has a very important purpose: effective decision-making. The data by itself is only as helpful as its inherent ability to help us make important decisions. Therefore, we should look at data with an eye towards the knowledge and insight we’re hoping to gain and decisions we are trying to make.

Table 1 outlines a few example decisions common to Defense Financial Management that may resonate with you:

Table 1: Decision Points for Financial Managers

Financial Managers

| Process | Example Decision Points | Relevant Data Elements |

| Formulation of defensible budgets |

Are we requesting resources for the right activities? Are our budgets aligned with Service and Department goals? Will our requests sustain Congressional review and prioritization? |

|

| Initial distribution and realignment of funds | Which plans should be incrementally funded? How should activities be sequenced? What adjustments will deliver the highest impact? What are we willing to risk? |

|

| Creation and management of Execution Plan |

How can we most efficiently execute our scarce resources to ensure maximum benefit to the organization? What is the appropriate allocation of funding across units? |

|

| Monitoring & reaction to budget adjustments | What falls below the line with budget cuts? Which programs can be deferred with the least impact? Should we reduce hardware quantities or support activities? |

|

| Contingency Planning in Continuing Resolution (CR) Environments | How do we most effectively spend what we’re allocated? How do we continue to maximize our obligations during a constrained fiscal environment? |

|

| Development and selection of Courses of Action (COAs) during unexpected adjustments (e.g., COVID-19) | How do we react quickly to changes? How do we fund what is most critical to the mission? How can we quickly identify assets and underperforming efforts that can be reallocated to emergent priorities? What is the impact of another “peanut butter spread?” |

|

| Prioritization and selection of Unfunded Requirements (UFRs) | How can we ensure taxpayer dollars are put to effective use? How do we align unfunded requirements in a way that makes sense? What activities are positioned for agile execution? Which projects should we fund as funds become available? |

|

Key decisions, and their associated data elements, are often tied to common processes within DoD Financial Management.

The Power of Decision Science

Put simply, “Decision Science is the collection of quantitative techniques used to inform decision-making.”[1] For our purposes, the important contribution of decision science is that it focuses on decisions as the primary unit of analysis. The paramount concern of this field of study is for making optimal choices based on available information.

Decision science recognizes that everything that happens in an organization, for better or worse, stems from the decisions made. For that reason, good decision-making within an organization becomes a force-multiplier. Using a sound methodology, framing up the decisions, selecting the essential data, and letting it inform you about what really matters are just some of the key concepts rooted in decision science.[2]

Here are three principles stemming from decision science that apply in organizational decision-making:

Principle #1: Organizational decision-making is an acquired skill

Quality decision-making doesn't just happen naturally. The good news is that it is something that can learned with effort and practice. The more people in an organization who have the mindset and the skills for making informed decisions, the more likely the organization will succeed.

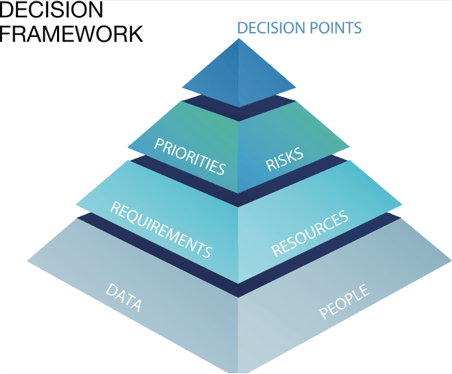

Principle #2: All decisions include basic building blocks

Different types of decisions may require different methods. If you understand the building blocks, you can hone in on your most relevant information and apply the most effective methodology.

Principle #3: Good decision-making is both an art and a science

The best decision-makers are those who have an ability to bring the right information (or data) and people together at the right level and time.

The art of decision-making includes effectively involving and empowering others, using intuition and experience, and obtaining buy-in and commitment from those involved. The science includes methodology, tools, and data. When blended appropriately, subject matter expertise along with quality data increase the probability of a good decision.

When the information we’re seeking is difficult to access and surrounded by a lot of noise, it loses its power. Likewise, when data is outdated, inaccurate, or unorganized, it becomes less meaningful. The key is to do the following:

- Organize and discipline the data in a way that enables better decision-making (science);

- Apply subject matter expertise and knowledge to validate assumptions (science & art);

- Layer in “contextual wisdom” to address the decision at hand (art).

Getting the data to work for you (not the other way around)

When the process of collecting and interpreting data is done collaboratively, it enhances buy-in and acceptance. More importantly, it improves decision-making. So, how does one create a transformational decision-making environment?

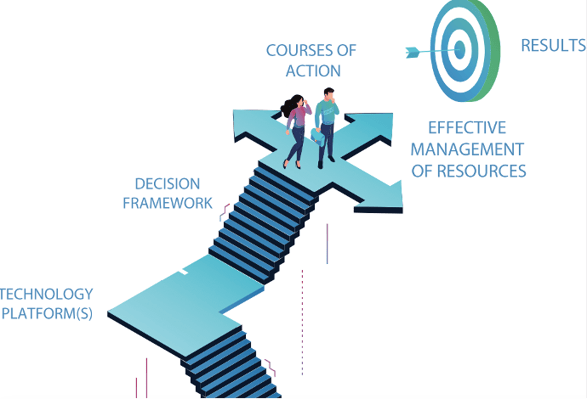

Technology affords the powerful union of data, information, knowledge, and wisdom. Software solutions facilitate collection, management, and synthesis of data for focused purposes. These solutions can be used to collect field expertise, establish and visualize priorities, and reveal insights. They can also enable real-time scenario planning, where users can change assumptions, run contingencies, and build “what-if” scenarios.

Technology can do even more than that. With the advent of machine learning (ML) and artificial intelligence (AI), certain technologies can use data to recommend prioritization and resource optimization choices. Specifically, technology can be used to compare planned project information to past data and predict the likelihood of success for future projects.

“Smart” technology can improve the quality of budgets and project portfolios, but must be employed smartly and cautiously.

Beware of black-box systems

One of the critical roles of a leader is to inform and ultimately make decisions. At the end of the day, humans make decisions. Machines do not. We should be wary of black-box systems that spit out an answer without the essential human judgment or insight. Technology should have the capability to receive input from subject matter experts, blend subjective and objective data, allow for adjustments, and accommodate hypothetical scenarios.

Strategically introduce new systems and tools

We must also be prudent about the way we introduce new systems into the environment. As financial managers, we may have lost count of how many “new” systems we have worked with over the years. Regardless of the results, the introduction of too many new technologies into the environment has a tendency to introduce “new system fatigue.” (Yes, we made that term up.) As a result, some develop a bias against implementing anything new.

Any new technology introduced into the environment should be easy to use, require relatively minimal training, and be intuitive and collaborative in nature. The right technology ideally will make a financial manager’s job easier, help their organization become more efficient at solving problems, and be on the cutting edge of force-multiplying decision support.

Force multiplying technology- US Air Force example

The examples below demonstrate that when an Air Force wing integrates technology into specific decision-making scenarios, it becomes a force multiplier. As an operational unit, the Air Force wing provides a dynamic and fairly representative example of many other DoD organizations.

Example 1: Prioritizing Requirements (e.g., UFRs)

Requirements prioritization is often a manual, time intensive, cumbersome process in the Air Force. Requirements are prioritized through financial working groups and discussed in financial management boards. They should align with the Wing “lines of effort” or goals. However, priorities are often racked and stacked based on arbitrary rankings without truly considering the validity or urgency of requirements.

Competing priorities among various groups is another real challenge. “Is the number one requirement for one group a higher priority than the number two requirement of another group? How can we assess this quickly, without locking everyone in a conference room for hours to cover down on every single requirement? Are we focusing on how the requirement aligns with the commander’s priorities?”

Using decision science and technology, the organization can significantly improve that process with a “living and breathing” unfunded requirements list – prioritized, on hand, and ready to adjust at any given time. The requirements have been vetted and “scored” by field experts. Leadership has also weighed in on the priorities, providing a clear line of sight to the strategy. When change happens (as it always does) the software proposes the next best project to pull forward based on value, risk, cost, or where it fits in the organization.

Example 2. Predictive Analysis (e.g., Obligation Plans)

For an Air Force wing comptroller or budget officer, navigating the fiscal year path can be bumpy and unpredictable. How accurately can they predict where obligations will be against goals in a few months? Can they determine which requirements need to be pulled forward or delayed based on the current operating environment?

The convergence of decision science, data analytics, and appropriate technology will allow you to assess real-time information and make decisions based on predictive analyses. With clear visibility into the status of their funds and based on organization-specific assumptions, budget officers and analysts can confidently predict obligation levels months down the road. If requirements are not obligated as planned, the “next best requirement,” – recommended based on key criteria – can be pulled forward. In addition, the technology has the ability to factor in historic data, the value or risk of the requirements, or other constraints (e.g., contract delays).

Example 3. Automated Planning Processes (e.g., “What-if” COAs)

Imagine having continuous visibility into the entire planning, programming, budgeting, and execution (PPBE) processes from the Wings to MAJCOMs to Air Staff – all centrally-managed in one or more integrated planning systems. Using decision science and technology, financial managers can centralize their most relevant planning data into one location.

Most financial managers have the ability to create, store, and analyze plans against actual execution data today, but the processes are often manual. When plans and actuals are appropriately connected, and the data is automatically updated under a sound framework, decision-making becomes more agile and fluid. During execution-year planning, you may be preparing to fund a series of line items similar to last year’s list. With decision technology, a mouse click could “accept” the plan based on the prior year data, and automated notifications will alert you of any important differences.

Some technologies allow “what-if” funding drills and outline COAs to recommend to leadership. Using machine learning and artificial intelligence capabilities, they propose options based on your organization’s framework and data. Empowered by this quick information, an exercise that could otherwise take days can instead, within hours, equip leadership with a set of tailored, strategic COAs for an informed, data-driven decision.

Conclusion

Effective decision-making brings the right data, people, and processes together – leveraging smart technology and frameworks – to ultimately get clear on the best courses of action. To be truly effective, decision-making must transform into a continuous planning process flow. As Under Secretary of the Air Force Matthew Donovan put it, “Our advantage in future battles depends on our ability to fuse vast amounts of data to accelerate our decision cycle to guarantee the success of any mission.”[1]

What financial transformation really means in the DoD today is how we think about and make decisions to get full value of taxpayer dollars. It requires a collection of data, processes, and technology to shape the defense fiscal environment and make opportunities for greater knowledge, insight, and wisdom. It builds on the echoes of past leaders and moves financial management forward to an advanced, connected future. This is a multi-year effort, but it can begin today with small steps, simple habit changes, and some quick wins.

The future is bright for financial managers. Innovative solutions are creating opportunities for better, data-driven decision-making on a continuous basis. With the help of technology and decision science, financial transformation will lead to transformational decision-making.

*The authors wish to thank Denise Mallett, primary advisor and technical editor of this article. In addition, the authors thank Daniel Saaty, Ted Reynolds, Caitie Murphy, David Rodriguez and Leslie Boppert for their review of the article. A most heartfelt thanks goes to the many FM leaders, analysts, and practitioners for their helpful insight and information in this overall effort to think about financial management differently.

Author Bios

Ashley M. Miller, CDFM-A, currently serves as a Senior Resource Management Analyst for the Fires Center of Excellence (FCoE), within the US Army Training and Doctrine Command (TRADOC). Ms. Miller oversees the programming and budgeting of the FCoE program. Her previous assignments included managing budget execution of the FCoE program and performing as a field level budget analyst.

Jason E. Williams, CDFM, Lt Col, USAF (ret) is currently CFO at Pergravis and is a member of the Tampa Bay ASMC chapter. Last summer, he finished up a 20-year USAF career as a financial management officer. His assignments included wing level, MAJCOM and Air Staff positions. In 2014, he was awarded ASMC’s Meritorious Service Award for Resource Management (Combat Zone) at the national PDI. His most recent assignments were as the comptroller squadron commander at Beale Air Force Base, CA and MacDill Air Force Base, FL.

Jonathan S Allen, JD/MPA is the Vice President of Customer Success at Decision Lens, Inc. Headquartered in Arlington, VA, Decision Lens is a leading cloud-based software company for government planning, prioritization and resource optimization. Jonathan oversees all implementation, training, and advisory support for some 80+ customers and serves as the Practice Lead for Decision Lens’ Financial Management Practice. A graduate of the Syracuse College of Law and the Maxwell School of Citizenship and Public Affairs, Jonathan is currently a member of the Utah ASMC

______________________

[i] “Summary of the National Defense Strategy of the United States of America,” 2018, p. 10. https://dod.defense.gov/Portals/1/Documents/pubs/2018-National-Defense-Strategy-Summary.pdf. See also “Message to the Force – Reform through Focused Prioritization,” Secretary of Defense, Memorandum for all DoD Personnel, 2 January, 2020. https://www.airforcemag.com/app/uploads/2020/01/MESSAGE-TO-THE-FORCE-REFORM-THROUGH-FOCUSED-PRIORITIZATION.pdf

[ii] T.S. Eliot, The Rock, (New York: Harcourt, Brace, and Company, Inc.), p. 7.

[iii] “What is Decision Science?” Center for Health Decision Science, Harvard T.H. Chan School of Public Health, https://chds.hsph.harvard.edu/approaches/what-is-decision-science/#:~:text=Decision%20Science%20is%20the%20collection,the%20individual%20and%20population%20levels. See also “What is decision science? Transforming decision-making with data,” www.cio.com, https://www.cio.com/article/3444636/what-is-decision-science-transforming-decision-making-with-data.html?upd=1598896165931

[iv] Many DoD FM leaders have stressed the importance of “data-driven decision-making.” For example, see John Bergin, “Analyze, Reform, and Innovate: Building a Culture of Performance within Financial Management,” Armed Forces Comptroller, Vol. 65, No. 1 (Winter 2020), pp. 20-22; see also “United States Air Force White Paper: The Digital Air Force,” July 2019. <https://www.af.mil/Portals/1/documents/2019%20SAF%20story%20attachments/USAF%20White%20Paper_Digital%20Air%20Force_Final.pdf?ver=2019-07-09-181813-390×tamp=1562710801965>.

[v] “Donovan stresses ‘Digital Air Force’s’ importance and necessity,” By Secretary of the Air Force Public Affairs, Published July 09, 2019. https://www.whiteman.af.mil/News/Article-Display/Article/1900112/donovan-stresses-digital-air-forces-importance-and-necessity/; see also “United States Air Force White Paper: The Digital Air Force,” July 2019. https://www.af.mil/Portals/1/documents/2019%20SAF%20story%20attachments/USAF%20White%20Paper_Digital%20Air%20Force_Final.pdf?ver=2019-07-09-181813-390×tamp=1562710801965.